|

Behind The Curtain – Understanding Bias in Valuation Reports©

Part VII, Identifying Bias in a Business Valuation

By David Goodman MBA, CPA/ABV/CFF, CVA and Les Gosule, MST, CPA/PFS, CVA

“All of us show bias when it comes to what information we take in. We typically focus on anything that agrees with the outcome we want.” – Noreena Hertz

Bias creeps into business valuations—either consciously or unconsciously. It is hardly surprising when the seller’s appraiser develops a higher valuation than the buyer’s. So, how is the consumer of a valuation report to know whether the author was biased—and in what ways?

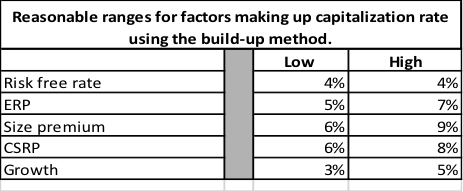

Here’s a case that shows how two valuations of the same business, even when based on the same information, can yield very different outcomes. Suppose two appraisers are engaged to value a business in a divorce case. In its most recent year, the business has an after-tax cash flow to equity of $100,000. The two appraisers agree to apply the income approach, and the capitalization of earnings method—using the “build-up” method to determine the capitalization rate. For demonstration purposes, let’s say they further agree on reasonable ranges for each factor, as follows:

Some definitions are in order. ERP, Equity Risk Premium, is the additional returns equity investors expect to receive on a publicly traded market index portfolio such as Dow Jones. The size premium reflects the additional return for the small cap stocks. CSRP stands for company-specific risk premium: an estimate of the risk inherent in investing in the particular subject company.

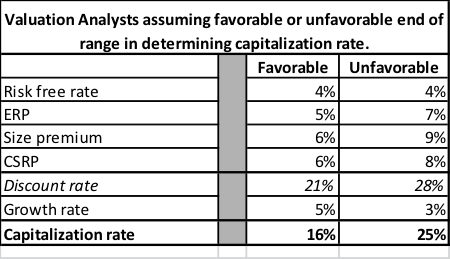

The following table shows the values chosen by each valuation analyst:

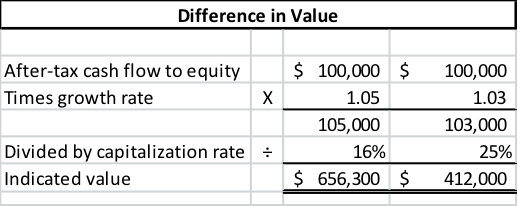

Now, here’s what happens when each calculates the value of the business:

In the above case, each valuation analyst, rather than exercise their unbiased professional judgment simply chose the corresponding factor most favorable to their client.

The above example depends on retrospective single-year cash-flow analysis. If multi-year retrospective analysis is applied, appraisers may disagree on how many years to consider, and whether a weighted average or a straight average is more appropriate. Differences of opinion may occur over reasonable compensation for the owner, fair market rent, effects of income tax liability, capital expenditures, working capital requirements, debt repayment, and new debts. It is important to understand what information the appraiser relied upon, what their range of choices was, and their thinking in choosing the values they used to reach their conclusion of a company's worth.

If the market approach to valuation is used, bias can enter into the decision whether to use a multiple or earnings, or a multiple of revenues, to calculate value. Appraisers may make unsupported adjustments to the multiples derived from market data. An appraiser may also rely on market data that is not relevant to the subject company. Understanding the appraiser's reasoning and basis for adjustments is important to identifying whether there is bias in appraiser's valuation.

Finally, and perhaps most importantly, is there transparency in what the appraiser did and how they reached their conclusion? The more transparent and supported a report is, the less likely the appraiser is trying to hide anything.

In Part VIII of this series, we will discuss Applicability of Approaches and Methods to the Standard and Premise of Value.

Gosule, Butkus & Jesson, LLP is a full service accounting firm serving Greater Boston, Massachusetts & New England, with extensive experience in performing business valuations in a variety of industries including construction, service, restaurants and dental practices. For more information, please see our website at www.GBJ-BestCPA.com. Also, please contact us if you would like us to do a presentation to your firm or clients on drivers of business value.

|